Money depreciation calculator

This Car Depreciation Calculator allows you to estimate how much your car will be worth after a number of years. Unit of Product Method.

Appreciation Depreciation Calculator Salecalc Com

The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life.

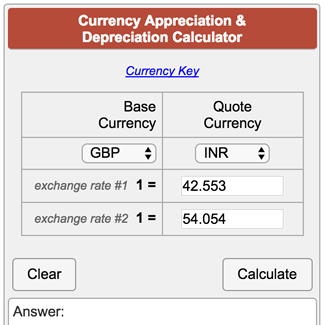

. Depreciation Amount Asset Value x Annual Percentage Balance. A calculator to quickly and easily determine the appreciation or depreciation of an asset. Finds the daily monthly yearly and total appreciation or depreciation rates based on starting and.

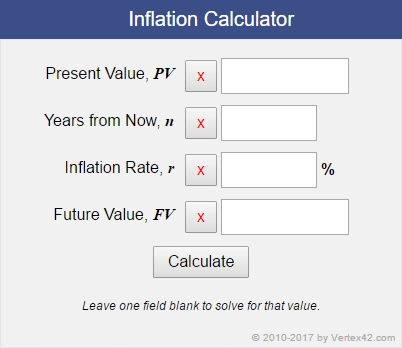

After a year your cars value decreases to 81 of the initial value. By entering a few details such as price vehicle age and usage and time of your ownership we use. An inflation calculator shows you the value of the same sum of money at different times in the past and the future.

Inflation Calculator Find US Dollars Value from 1913-2022 This US Inflation Calculator measures the buying power of the dollar over time. You can understand the workings of a Depreciation calculator with this formula. The formula for calculating appreciation is as.

Sum of digits depreciation Depreciable cost x Balance useful lifeSum of years digits Example. A good way to do so is to measure by what percentage the currency has depreciated. Where SYD is the addition of digits of each year of an assets useful life.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Depreciation per year Asset Cost - Salvage Value Useful Life Years Units of production depreciation In. The formula for this type of depreciation is.

To use it just enter any two dates from. Non-ACRS Rules Introduces Basic Concepts of Depreciation. Calculate Car Depreciation By Make and Model Find the depreciation of your car by selecting your make and model.

It can tell you about historic prices and future inflation. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. To do that divide the difference between the costs of the baskets of products at.

This calculator allows you to calculate the total amount of money you have just enter the number of bills and coins. Read our guide to find out the methods you can use to save money without. The calculator also estimates the first year and the total vehicle depreciation.

You can then calculate the depreciation at any stage of your. Use this depreciation calculator to forecast the value loss for a new or used car. Save Money On Existing Credit Cards Can you save money without switching your credit card.

Our car depreciation calculator uses the following values source. Yearly Depreciation Value remaining lifespan SYD x asset cost salvage value. The formula of the depreciation and appreciation is the same rates are either below zero depreciation or above zero appreciation.

After two years your cars value. Depreciation is handled differently for accounting and tax. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of.

Depreciation Calculator

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Calculator Definition Formula

/dotdash_Final_Currency_Appreciation_Definition_Apr_2020-01-063bf4cdbc9e4f4d82fa4aa46738498d.jpg)

Currency Appreciation Definition

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Currency Appreciation And Depreciation Calculator

How To Calculate The Depreciation Of Currency Accounting Education

Depreciation Calculator Depreciation Of An Asset Car Property

Inflation Calculator For Future Retirement Planning

Straight Line Depreciation Calculator Double Entry Bookkeeping

Depreciation Rate Formula Examples How To Calculate

Annual Depreciation Of A New Car Find The Future Value Youtube

How To Calculate The Depreciation Of Currency Accounting Education

Appliance Depreciation Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

Reducing Balance Depreciation Calculator Double Entry Bookkeeping